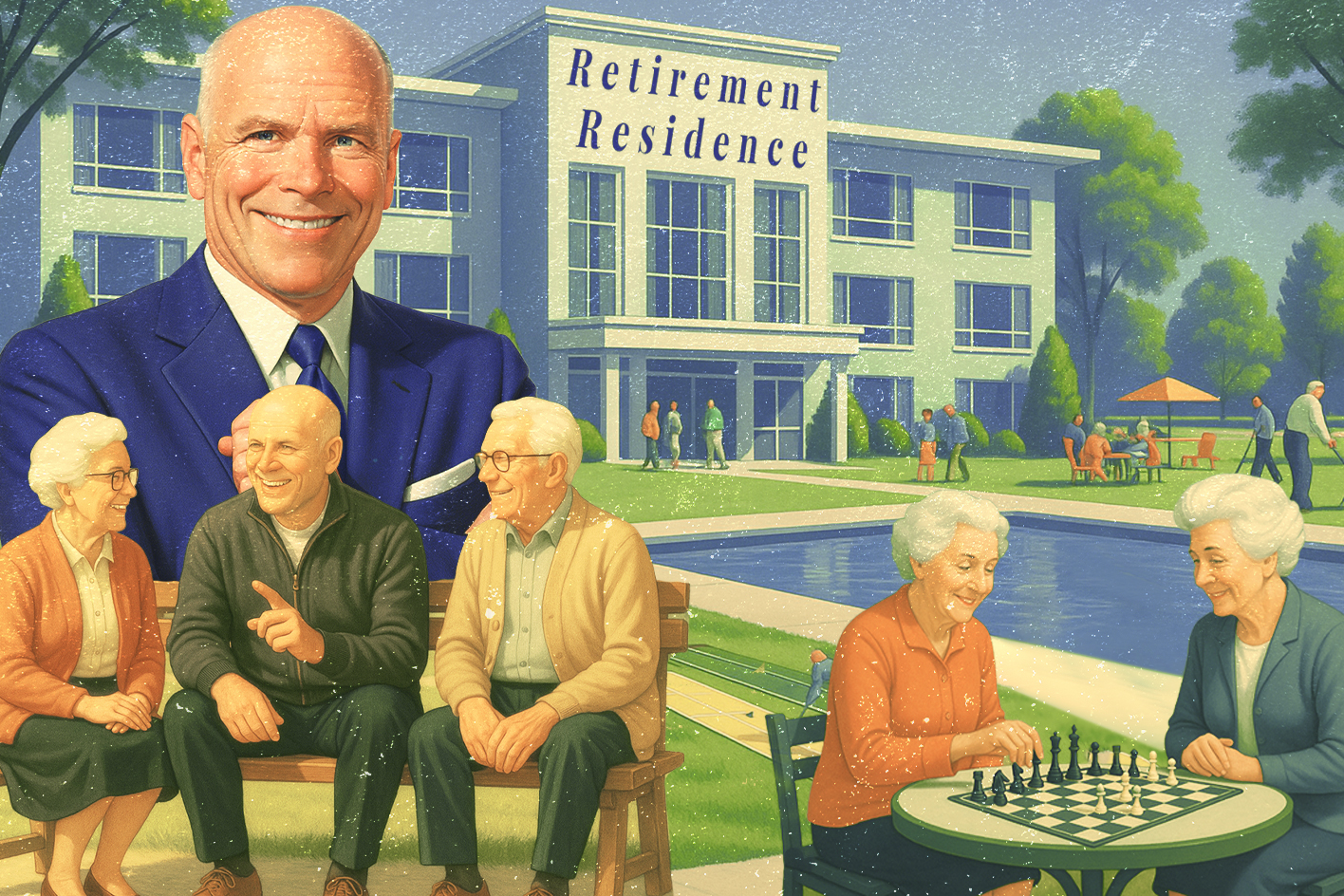

To Move or Not to Move? A Framework for Making Your Next Housing Decision

Many people find themselves caught in an endless loop of later life housing questions: staying put versus moving, renovating versus downsizing, choosing between a smaller home, condo, or retirement residence. If these choices leave you feeling overwhelmed, know that you're far from alone.

It is the question that permeates almost every conversation as we get older: “Where do we go from here?”.

For many of us, the family home isn't just a building. It is where we raised our children, where we celebrated decades of holidays, and where every room holds a story. The very idea of leaving that behind can cause emotional paralysis. Often, the fear of making the wrong choice, the magnitude of the process, or simply the denial that our needs are changing stops us from making any decision at all .

But here is the truth I share with families across Ontario: Most Canadians want to age in place, it just has to be the right place .

This article is not about convincing you to move. It is about giving you a framework, a later life housing transition plan, so that you (or your parents) can evaluate your options calmly, clearly, and without pressure.

Forget about Where to move, What to buy and How will I sell my home. Focus on “Why am I thinking of moving?”

The 3 Questions That Can Get you to the Why

We often wait for a dramatic sign to consider a move: a fall, a health scare, or the loss of a spouse . But waiting for a crisis takes the control out of your hands. To decide wisely whether you should move or stay, we need to shift from emotional denial to practical quality of life. Instead of asking, "Can I still manage?", ask yourself these three questions:

1. Is the home working for you or against you?

Look at your home objectively. Are you avoiding the stairs? Is the laundry room in the basement, turning a simple chore into an odyssey?. Are you worried about slipping in the shower?.

We often tell ourselves we need the four-bedroom house "so the kids can stay over", even if the kids are 60 years old and rarely visit .

Try this simple exercise: Look at your daily routine. If your life has shrunk to just the kitchen, the TV room, and the bedroom because the rest of the house is too much to manage, the home is no longer serving you .

The Why? The home's structure is not meeting my current needs

2. Are you socially connected, or just "not lonely"?

This is critical, especially if you are an adult child concerned about a parent. We sometimes treat it like a "badge of honour" that Mom is 92 and still living alone in her own house. But when was the last time she had a meaningful conversation with someone outside the family?

As we age, our "circle of influence" shrinks naturally: neighbours move away, friends pass on, and driving becomes difficult. Isolation is a silent health risk. A timely move can mean recovering daily friendships and conversation, something vital for our mental health.

The Why? My present home and neighbourhood does not offer many opportunities for socialization

3. Activities of Daily Living: What activities would you like to be easier?

This is an empowering question. Maybe it is not having to cook three times a day, not worrying about stairs, bathtubs or the laundry in the basement. Help with outside activities such as gardening and snow removal, or simply having someone nearby if you need help.

The Financial Reality: The Cost of Maintaining a Home

One of the biggest barriers to decision-making is the belief: “My house is paid for, I live here for free”.

But when we look at the math honestly, your home is never free. To compare apples to apples, you must tally the actual cost of staying home:

- Property tax and insurance.

- Utilities (heat, hydro, water).

- Maintenance and repairs (roof, furnace, appliances).

- Services: Snow removal, yard work.

- Future repairs

- Updating and decorating

Retirement Community LIving vs Staying at Home

Staying at Home

If you decide to stay home and eventually need support with Activities of Daily Living (ADLs) like bathing or dressing, hiring private care can ease a lot of burdens. Unfortunately as needs increase so do home care costs, a once cost effective solution becomes the most expensive option.

Retirement Residence

Typically bundles accommodation, meals, housekeeping, and activities into one predictable monthly fee. One of the fears people have in considering a retirement residence is the feeling of a loss of independence. Many people confuse Retirement Residences with Long-Term Care (the old "nursing homes").

It is vital to understand the difference:

- Long-Term Care (LTC): This is a medical model, subsidized by the government, for people with high physical or cognitive care needs. Admission is priority-based, usually following a crisis or hospital stay .

- Retirement Residence (Private Pay): Some people might compare it to a cruise ship on land. There are different types of cruises, depending on the cost, even boutique cruises. But on all of them, you have the freedom to come and go as you please, the opportunity to socialize with people next door, your own private room, and even a chef who prepares your meals. You don't lose independence; you gain freedom from the chores that weigh you down .

Your Transition Plan: How to Decide Without Pressure

If you are looking for signs it is time to move, don't wait for a fall. The best time to plan is while you are still in control of your health and your choices.

Here is a simple framework to start today:

- Do a "Safety Audit": Is your bathroom safe? Are there throw rugs you could trip over? Sometimes, simple modifications like grab bars or better lighting can extend your time at home safely .

- Put the numbers on paper: If you are an adult child supporting a parent, help them write down the real expenses of the current home versus a residence fee. Seeing the info reduces the fear.

- Try Before You Decide (Trial Stays): This is my favourite recommendation. Many residences offer "trial stays" or "winter stays." You can move in for 30 days, enjoy the warm meals and company, and see how it feels, with zero commitment to sell your house.

Conclusion: Planning Protects Your Choice

Inaction is a decision in itself. Unfortunately, I see too many families wait until a dramatic health event forces their hand, and in that moment of crisis, their options shrink dramatically.

Having a plan doesn't mean you have to move tomorrow. It means you and your family have had the tough conversations, evaluated the options calmly, and know exactly "where to go from here" when the time is right. That is true independence.

Need clarity on your current options?

You don’t have to do this alone. If you want to know where you stand or what specific options exist in Halton, Peel, or Hamilton for your situation:

Book a 30-minute options call with me. No sales, no pressure, just an honest chat to review your plan. Let's talk ☕

Categories

Recent Posts

GET MORE INFORMATION